Loan tax return

Whether you want to buy a new home, finance your dream car, or further your education – loans offer the opportunity to make major purchases and investments without having to cope with immediate financial burdens. But that’s not all: they can also bring tax advantages if they are used for certain purposes. In this article, you will find out what types of loans there are and how you as a borrower can potentially benefit from tax relief.

What is a loan?

A loan is an agreement between a lender and a borrower in which the lender provides the borrower with a certain amount of money that must be repaid at a later date. Repayment can be made in a single payment or in installments.

Under Swiss law, a loan is a so-called consensual contract in which the borrower’s repayment obligation is a central contractual condition. In most cases, the borrower also undertakes to pay interest on the borrowed amount, which serves as remuneration for the borrowed money – this is often referred to as “debt interest”.

However, if no interest is charged, it is an interest-free loan. The amount of the loan and the exact conditions for repayment are usually set out in a loan agreement.

In everyday life, the terms “loan” and “credit” are often used interchangeably. However, when money is lent informally from one person to another – for example to a daughter or son – it is more commonly referred to as a personal loan.

Unlike a gift, however, a repayment with possible interest is also due here. Otherwise, a loan usually refers to a personal loan in accordance with banking regulations, where a bank or credit institution lends money to a private individual.

Different types of loans

There are a variety of loans that are structured differently depending on their purpose and conditions. There are the following types of loans:

- Personal loans: These loans are used for personal needs such as renovations or major purchases.

- Business loans: Business loans are specifically for companies to obtain working capital, make investments, or bridge liquidity bottlenecks.

- Consolidation loans: These loans are used to consolidate multiple debts into a single monthly payment.

There are also other specific types of loans. The most common types of loans are real estate loans, car loans, and student loans. However, other installment loans also fall under the term “loan”.

Loans for real estate

Real estate loans are specifically designed for the purchase, construction, or renovation of real estate. They generally have longer terms and lower interest rates compared to other types of loans. Real estate loans include:

- Mortgage loans: Long-term loans that are secured by the property itself. They can have fixed or variable interest rates.

- Construction loans: These loans are intended for the construction of a new home and are often paid out in installments – depending on the progress of construction.

- Renovation loans: These loans are used to finance renovation or modernization work on an existing property.

Car loans

Car loans are special loans that are used for the purchase of a vehicle. They usually have shorter terms than mortgage loans, often between two and seven years. Interest rates can vary depending on the borrower’s creditworthiness and the age of the vehicle.

Due to their tax deductibility, car loans are often the better choice than leasing. This allows you to claim the interest costs of the loan against tax, whereas you generally do not benefit from paying the monthly leasing costs.

Student loans

Student loans are specifically designed to finance educational costs. These loans help students cover tuition fees, books, accommodation, and other expenses associated with their studies. They often have special repayment terms that allow students to begin repayment after graduation.

There are also different types of student loans, each with different conditions. The most common include the following:

- Public student loans: These student loans are offered by government institutions and often have favorable terms and flexible repayment options.

- Private student loans: Private student loans are offered by banks or other financial institutions and may have more variable interest rates and terms.

Other installment loans

In addition to the types of loans mentioned above, there are many other installment loans that can be used for different purposes. Installment loans are characterized by the fact that repayment is made in regular installments.

Unlike an annuity loan, where the installments remain constant, the installment of an installment loan often consists of a constant repayment portion and a decreasing interest portion.

The various installment loans include:

- Consumer loans: Unsecured loans such as consumer loans or personal loans can be used for a variety of consumption purposes – from buying a new washing machine to consolidating debts.

- Instant loans: Instant loans are quickly available loans with short terms and often higher interest rates – ideal for emergencies.

- Small loans: This type of installment loan offers small loan amounts with short repayment periods, which can often be applied for online or via credit platforms.

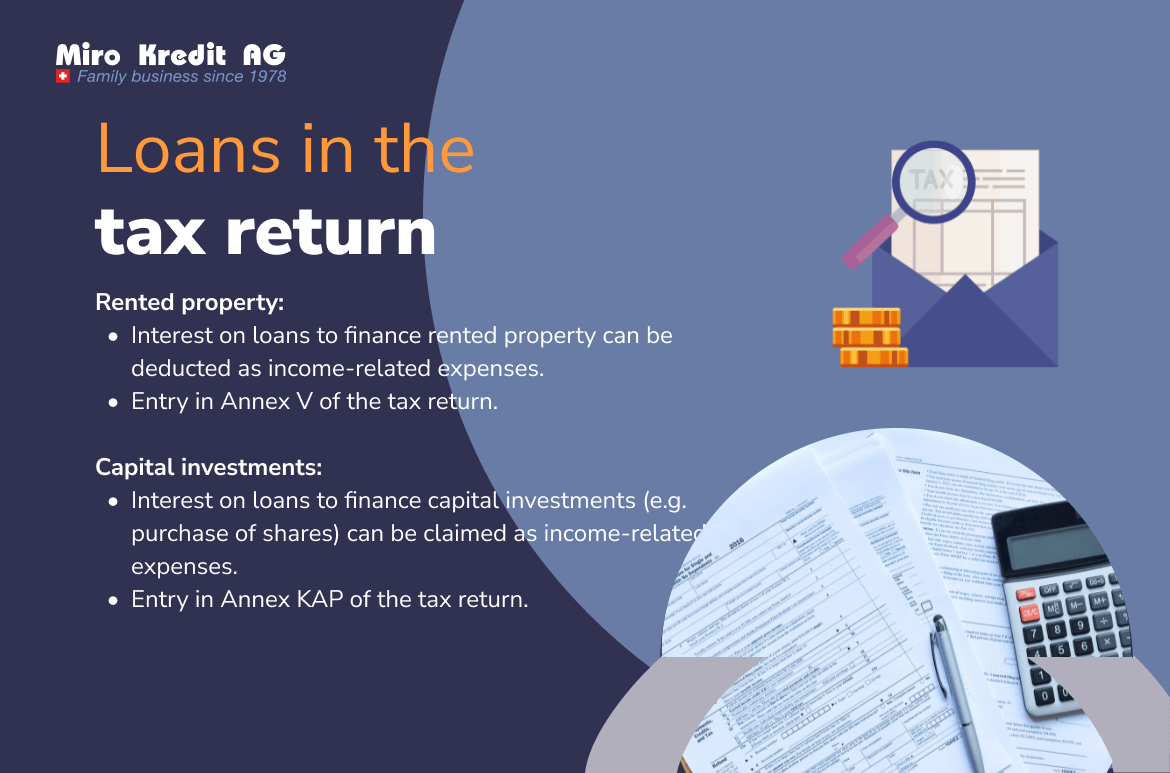

Deducting the loan from the tax

Most consumers are aware that mortgage interest is tax-deductible. However, as a borrower, you can also claim the interest on a loan in your tax return. As a private individual, you can deduct the debt interest paid in the current tax year from your taxable income.

The interest is deductible for both federal tax and municipal tax purposes. The upper limit here is a maximum of CHF 50,000

How does it work?

At the end of each tax year, you will receive a tax certificate from your lender showing the interest paid. You can then deduct this amount from your tax accordingly. If you do not receive the tax certificate automatically in January, you can also request it directly from your lender.

To be able to deduct the interest on your personal loan for tax purposes, you must enter it in your tax return in the “Personal Debts” section. In addition to the deductible interest costs, you must also enter the amount of the outstanding debt here. You can then attach all interest certificates to your tax return and submit them to the tax authorities.

What loan interest can be deducted from tax?

Not all loan interest is tax-deductible. As a rule, only interest on the following types of loan can be deducted:

- Private loans: If you have borrowed money from other people in return for interest, you can deduct this interest. A written loan agreement should serve as proof of this.

- Personal loan: The interest on consumer loans is also deductible. As already mentioned, you will receive a confirmation from the bank at the beginning of the year for your tax return.

- Credit cards: If you have used the installment facility on your credit card, you can also deduct this interest from your taxes. The credit card provider will send you a corresponding receipt for the tax authorities.

- Mortgage: The interest costs for mortgage loans can also be deducted. Your lender will provide you with a tax certificate for this purpose.

What exactly is tax deductible?

To avoid making a mistake in your tax return, you should check your details carefully. Please note that only the interest on the loan is tax deductible and not the total monthly payments to the lender.

The monthly installments consist of a repayment portion and the interest. The repayment portion is not deductible, so you can only declare the interest on your tax return.

FAQ

Conclusion

A loan in the form of a personal loan not only offers the advantage that you can use the money to fulfill your financial wishes, but you can also deduct the interest paid from your taxes. By making the right use of these tax advantages, you can save costs and reduce your tax burden. If you have any further questions, you should contact your tax advisor.

Private loan calculation example

Loan amount: CHF 10,000 without insurance.

Repayment period: 12 months

Interest (including costs) amounts between CHF 240.50 and CHF 574.25. Effective interest rate 4.5% – 11.95%. Possible loan repayment period from 12 to 120 months

Processing fees: CHF 0.-. Granting a loan is prohibited if it leads to over-indebtedness (§ 3 Unfair Competition Law – UWG)