When do I need credit insurance?

Credit insurance can be a valuable safeguard in certain situations, especially when it comes to loans or business risks. It protects both companies and private individuals from the financial consequences if a borrower is unable to make payments.

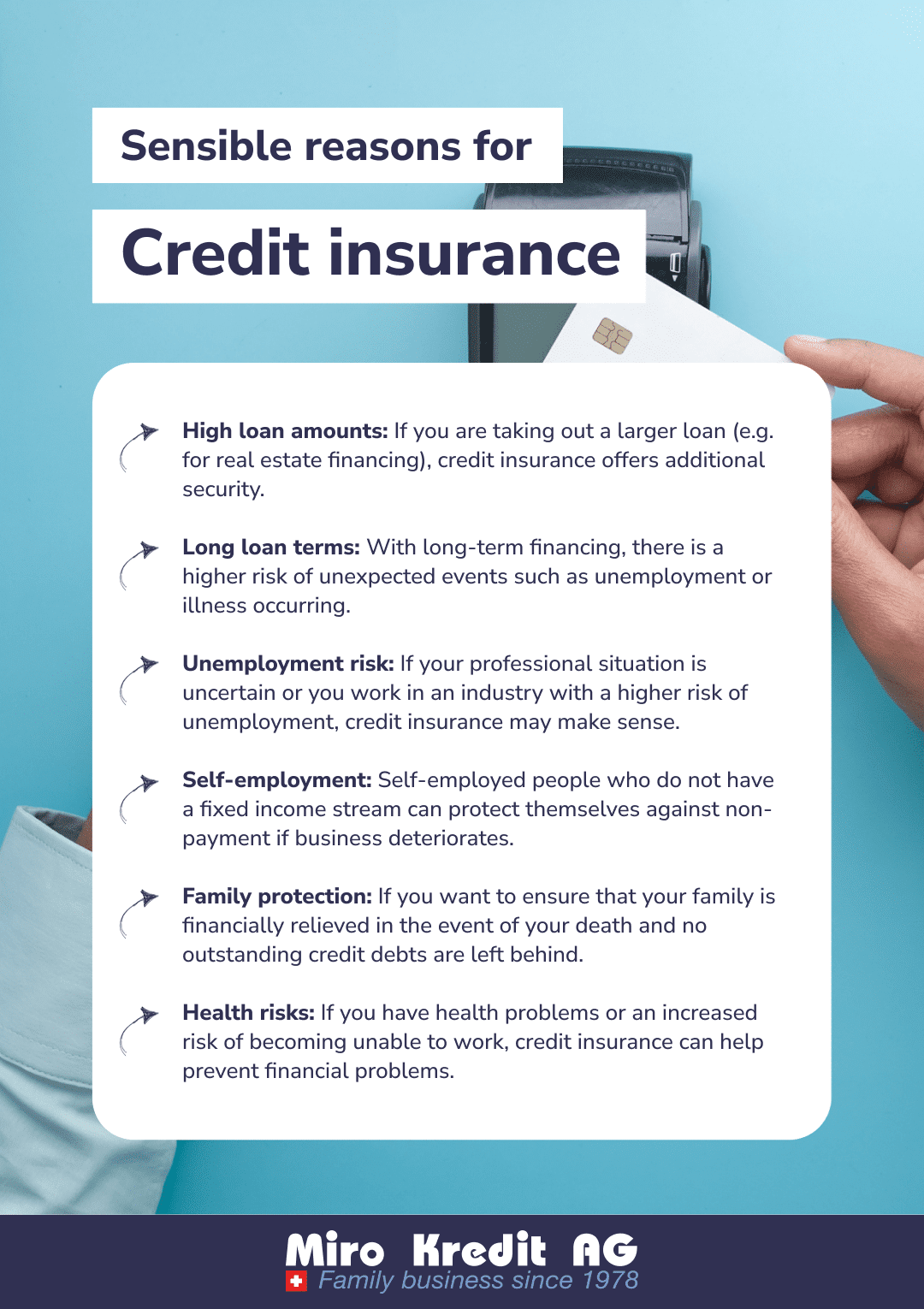

But when exactly does it make sense to take out credit insurance? This question is not always easy to answer, as it depends on various factors, such as the amount of the loan and your own financial situation. In this article, you will find out how credit insurance works, when it makes sense and what benefits it offers to cover your risks.

Credit insurance: how it works

Credit insurance protects you against financial losses that arise if the borrower can no longer pay their installments – whether due to unemployment, illness or insolvency. In such cases, the insurer steps in and covers all or part of the outstanding payments. Credit insurance thus offers security, especially for larger loans such as construction financing or business loans.

The way it works is relatively simple: you take out the insurance either directly when you take out the loan or separately with an insurance company. The insurance is often linked to the loan amount and the term of the loan so that it is tailored precisely to your financial obligations. There are different types of credit insurance, depending on the type of risk you want to cover. For example, residual debt insurance covers death, unemployment or incapacity to work.

Credit insurance is particularly useful for companies to protect themselves against payment defaults by business partners. In this case, the insurance covers the loss of receivables if the customer becomes insolvent.

Credit insurance therefore offers an additional layer of protection that helps you to minimize financial risks and secure your credit obligations even in difficult situations.

Benefits of credit insurance

Credit insurance offers valuable benefits in many situations. It can provide crucial protection for both private individuals and companies, especially when it comes to avoiding financial losses due to payment defaults. But what exactly does credit insurance do for you?

Costs of credit insurance

The cost of credit insurance depends on several factors, such as the amount of the loan covered, the term and the risks covered. As a rule, you pay a monthly or annual premium, which is calculated depending on the amount of the loan and the insured risks.

However, these premiums are often significantly lower than the costs that could arise from an unsecured payment default. It is therefore worth weighing up the costs of credit insurance carefully against the potential risks.

Overall, credit insurance offers a secure way of protecting yourself against unforeseen payment defaults – both in the business and private sectors.

We can also provide you with valuable tips for applying for a loan.

Advantages at a glance

Credit insurance offers numerous advantages that can benefit you both financially and in terms of security. Here are some of the most important benefits at a glance:

- Financial protection: If you default on payments due to unemployment, illness or even death, the credit insurance will step in and cover the installments. This means you don’t have to worry about repaying your loan.

- Protection against unexpected events: Unforeseen situations can occur, especially with long-term loans such as construction financing. Credit insurance protects you against the financial consequences of such events.

- Reassurance for lenders: Banks and lenders often like it when a loan is secured by insurance, as this minimizes the risk of default.

Credit insurance therefore not only gives you financial security, but also the peace of mind that you will be supported in difficult times.

Overview of cover and protection

Credit insurance offers comprehensive protection and covers various risks that protect you or your company in the event of payment defaults. The scope of cover can vary depending on the type of credit insurance, but in general it protects against financial burdens that arise if you can no longer pay your loan installments due to unforeseen events.

The most common risks covered include unemployment, incapacity to work due to illness or accident and the death of the borrower. In these cases, the insurance covers the remaining loan installments or at least part of them. This relieves you or your family financially and ensures that ongoing payments are not missed.

Protection against payment defaults by business partners is particularly important for companies. If a customer becomes insolvent, credit insurance covers the outstanding receivables and thus secures the company’s cash flow.

The exact scope of protection depends on the policy selected. It is important to check the insurance conditions carefully to ensure that all relevant risks are covered. With comprehensive credit insurance, you are on the safe side in case unforeseen financial challenges arise.

FAQ

Before you take out credit insurance, a number of questions often arise. Here are the answers to common questions that can help you better understand how credit insurance works and the benefits it offers.

Find out here not only what credit insurance generally covers, but also exactly when credit insurance pays out.

Conclusion

Credit insurance can be a valuable safeguard in various situations, whether you are planning major financing or want to protect your company against payment defaults. It offers financial security and protects you or your family from the consequences of unforeseen events such as unemployment, illness or even death. Companies benefit from this insurance by protecting themselves against bad debts and thus keeping their business operations stable.

It is important that you know exactly what your credit insurance covers and ensure that it suits your personal or business situation. Not every insurance policy covers all risks, so you should check the policy carefully and, if in doubt, look for a tailor-made solution. You should also weigh up the costs and benefits – credit insurance is particularly worthwhile for large loan amounts or if there is a risk of payment defaults.

With the right credit insurance, you can rest assured that you are financially secure even in difficult times. It is therefore worth investing in this additional security so that you can plan better in the long term and avoid financial bottlenecks.

Read on to find out how you can easily pay off credit cards.

Private loan calculation example

Loan amount: CHF 10,000 without insurance.

Repayment period: 12 months

Interest (including costs) amounts between CHF 240.45 and CHF 523.30. Effective interest rate 4.5% – 9.95%. Possible loan repayment period from 12 to 120 months

Processing fees: CHF 0.-. Granting a loan is prohibited if it leads to over-indebtedness (§ 3 Unfair Competition Law – UWG)