Credit furniture

Are you planning a move or would you like to refurnish your apartment or house? Then you will usually need the appropriate capital for the furnishings. However, the available budget is not always sufficient to buy all the necessary furnishings and furniture immediately. In such cases, a furniture loan can be useful.

At Miro Kredit AG you will find personal loans at particularly favorable conditions so that you can fulfill your dream home as quickly as possible.

Personal loan for the purchase of furniture

Miro Kredit AG offers you a user-friendly and transparent platform for loan comparisons that enables you to find the right personal loan for the purchase of your furniture. With our online loan calculator, you can obtain your first non-binding and free loan offer. Simply enter the desired loan amount and term and you will immediately receive an overview of the monthly installment including interest.

A furniture loan allows you to conveniently finance the cost of your dream home without having to spend your entire budget in one go. Thanks to the flexible repayments, you can easily adapt your financial burden to your individual possibilities.

This is why a loan can make more sense than paying in cash

A cash payment may seem tempting at first glance, as you don’t have to pay any interest. However, there are several reasons why a personal loan can make more sense for furniture purchases. Firstly, financing with a loan allows you to maintain your liquidity, giving you more leeway for unforeseen expenses. In addition, the staggered repayment allows you to better control your financial burden.

Another advantage is that you can get particularly good conditions for your furniture loan if you have a high credit rating. A loan can be a suitable solution, especially if you need additional capital quickly and saving is not an option. A loan is also particularly suitable for long-lasting purchases such as furniture, as the costs can be spread over a longer period of time.

Avoid high credit card interest rates on purchases

People often tend to make their furniture purchases with a credit card. However, this can lead to high credit card interest rates, which significantly increase the overall costs. With a personal loan through Miro Kredit AG, you can avoid these high interest rates and benefit from significantly more favorable conditions.

Financing your furniture with a personal loan is therefore a particularly advantageous and flexible solution. Miro Kredit AG is at your side as a trustworthy partner to help you choose the best loan for your furniture purchase. Take advantage of the benefits of targeted financing and design your life within your own four walls according to your own ideas!

What is the difference between a credit and a loan?

The terms “credit” and “loan” are often used interchangeably, although there are some subtle differences between the two. Basically, a loan is a temporary transfer of money or assets that the borrower must repay – often with interest. This primarily refers to consumer credit.

A loan, on the other hand, is a special form of credit where a fixed sum of money is provided for a certain period of time. Loans are therefore often found among private individuals who lend each other money without charging interest. However, Swiss banks also use the term loan – for example for financing with deposited collateral.

What do you have to do to get a loan?

If you would like to take out a furniture loan, the loan application pis the first formal step. To do this, you must first select your desired loan using the online loan calculator. You then need to enter your personal details and professional situation. As soon as you have entered all the information, you can submit the online application.

Once the application has been submitted, the lender will check your information and carry out a credit check. A successful loan application leads to the approval and signing of the loan agreement, which sets out the exact terms of your personal loan. To ensure that your chances of obtaining a Swiss furniture loan are good, you must meet the following requirements:

- Age of majority: The basic requirement for applying for a Swiss loan is that you are of legal age. To be able to apply for a loan in Switzerland, you must therefore be at least 18 years old.

- Swiss citizenship or residence permit: In addition to being of legal age, you must either hold Swiss citizenship or be in possession of a valid B, C, or G residence permit. Residence in Switzerland is also required in order to obtain a Swiss loan.

- Regular income: A stable source of income is also important for you as a borrower in order to obtain a loan. You should therefore be able to provide evidence of regular income that is sufficient to cover the monthly loan installments.

- Good credit rating: Last but not least, a good credit rating is essential for approval of a personal loan. Lenders are obliged to check your previous credit history and payment behavior to ensure that taking out a loan will not lead to over-indebtedness.

What is the current interest rate for a loan?

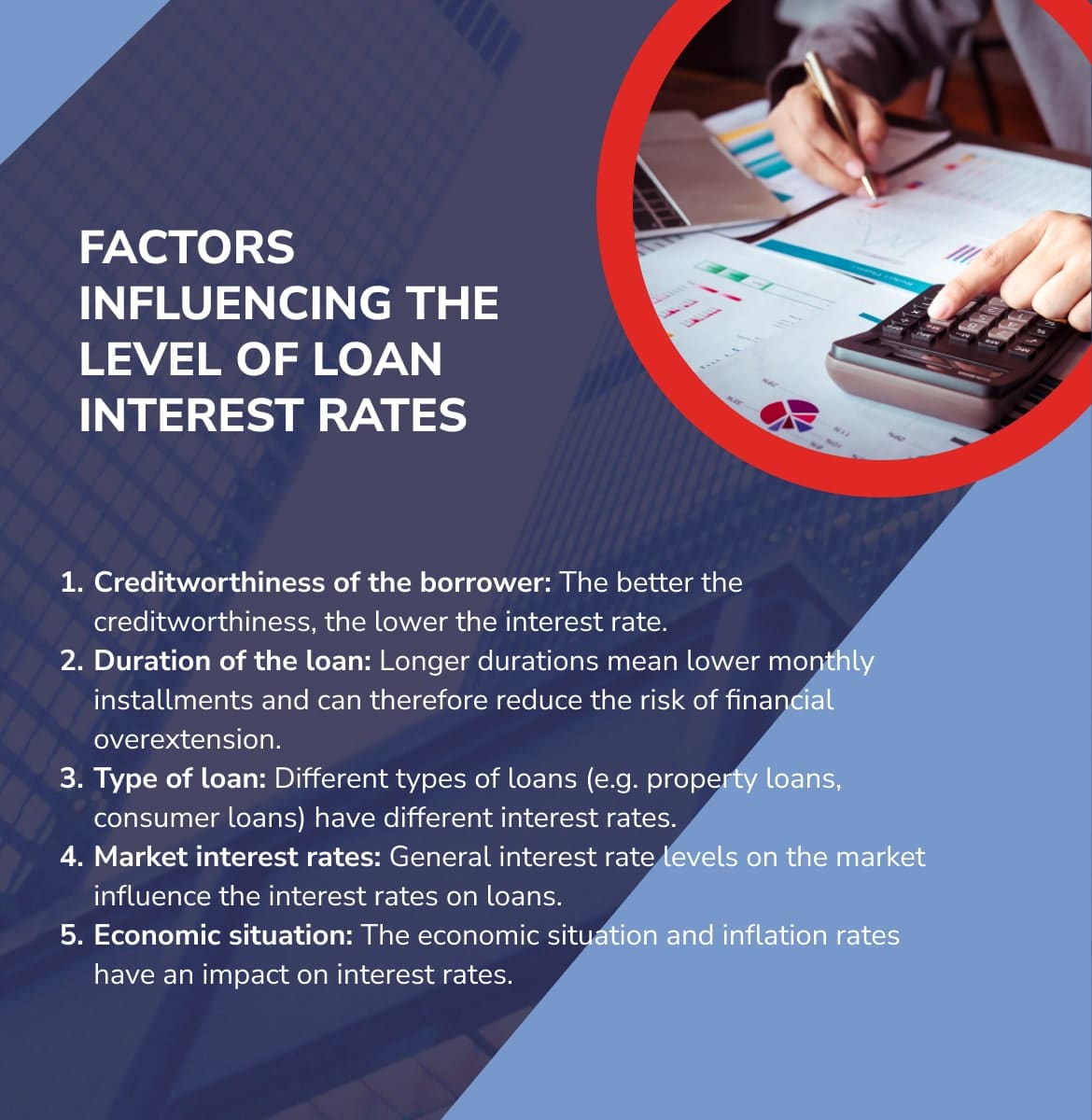

The loan interest rate is usually determined based on your desired loan amount, the term, and your credit rating. Interest rates currently range between 4.5 and 11.95 percent (as of 2024). Interest rates can vary from lender to lender.

We at Miro Kredit AG make every effort to always offer you the most favorable loans at the best conditions. The estimated total costs of your loan can be easily calculated with the free, non-binding online loan calculator from Miro Kredit AG. In this way, Miro Kredit AG offers you a transparent platform to compare different loan offers and find the best interest rate for your individual needs.

Household financing: find the right solution with Miro Kredit

Buying new furniture, renovating your home or unforeseen household expenses often require financial flexibility. At these times, Miro Kredit is your reliable partner for tailor-made financing solutions with the right online loan. Whether it’s a new kitchen, a computer, a TV, or new furniture – our online loan can be used for anything and offers you transparent conditions as well as low interest rates.

Conclusion

Whether you’re redesigning your living space or paying unexpected bills, we offer a wide range of loan options. Our user-friendly platform allows you to compare the best loan offers and find the perfect financing partner for your individual needs. With Miro Kredit, you can shape your financial future around your household in a simple, transparent, and efficient way.

Private loan calculation example

Loan amount: CHF 10,000 without insurance.

Repayment period: 12 months

Interest (including costs) amounts between CHF 240.50 and CHF 574.25. Effective interest rate 4.5% – 11.95%. Possible loan repayment period from 12 to 120 months

Processing fees: CHF 0.-. Granting a loan is prohibited if it leads to over-indebtedness (§ 3 Unfair Competition Law – UWG)