Credit for car Switzerland

Have you finally discovered your dream car, but can’t afford it at the moment? With the right loan, that doesn’t have to be an obstacle! The current trend is towards flexible consumer behavior, which does not exclude the purchase of a car. The majority of vehicles are no longer financed with savings, but with the help of a loan or leasing contract.

Miro Kredit AG will help you find the right loan for your needs. You can also find out here how best to finance a car in Switzerland and what the advantages of intelligent car financing are.

Are you still unsure whether you should lease or buy your dream car? You will also find important tips and advice on this below. If you have any further questions, you can contact us at any time.

What is the best way to finance a car?

You can finance a car in different ways. Which option you should choose depends on various factors. Cash purchase is the cheapest option. You become the owner of the car, so you are free to decide on the equipment and insurance. Credit buyers are also considered cash buyers. This means that if you do not currently have the purchase price for the car at your disposal, you can finance it with a loan.

Advantages of intelligent car financing

When buying a car, it is important to think not only for the moment, but also for the long term. Intelligent car financing, such as buying on credit, leasing, or a car subscription, can pay off later.

Before you make a decision about the type of financing, you should be aware of your priorities. Would you like to put together your dream vehicle yourself or would you rather have it convenient? Depending on what applies to you, the options mentioned have different advantages and disadvantages.

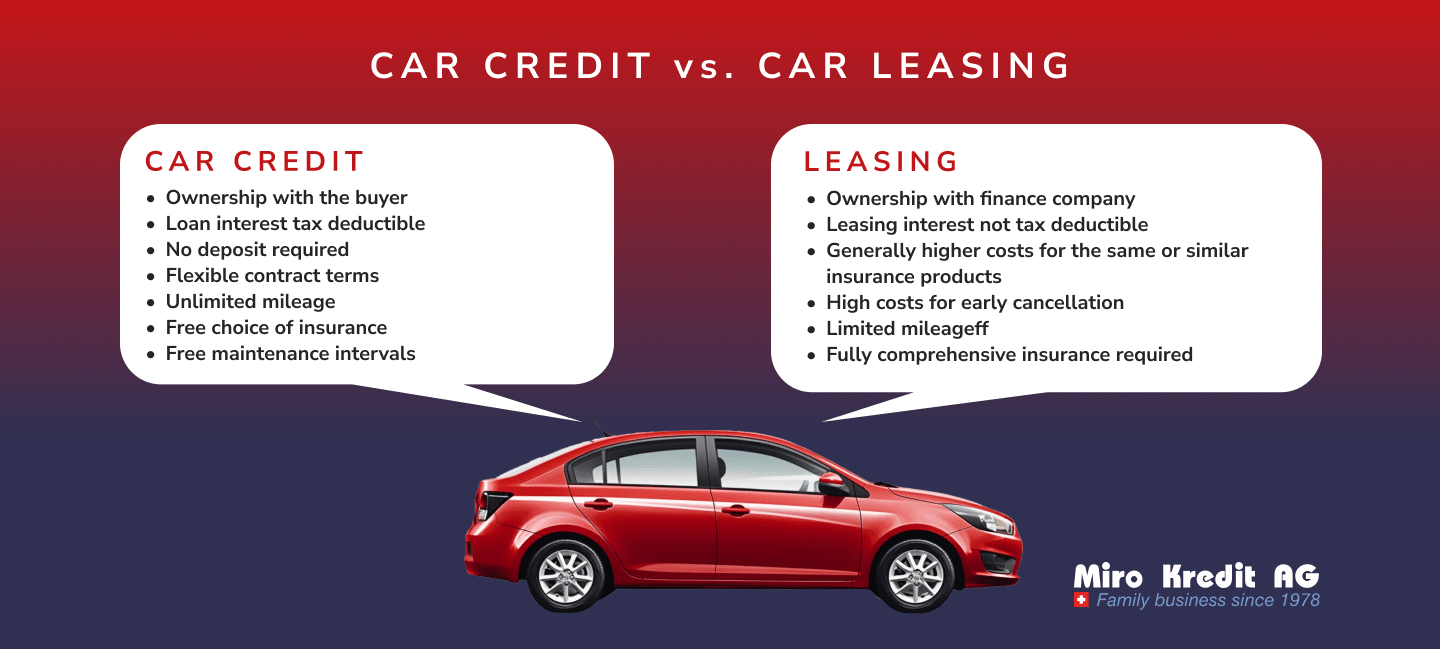

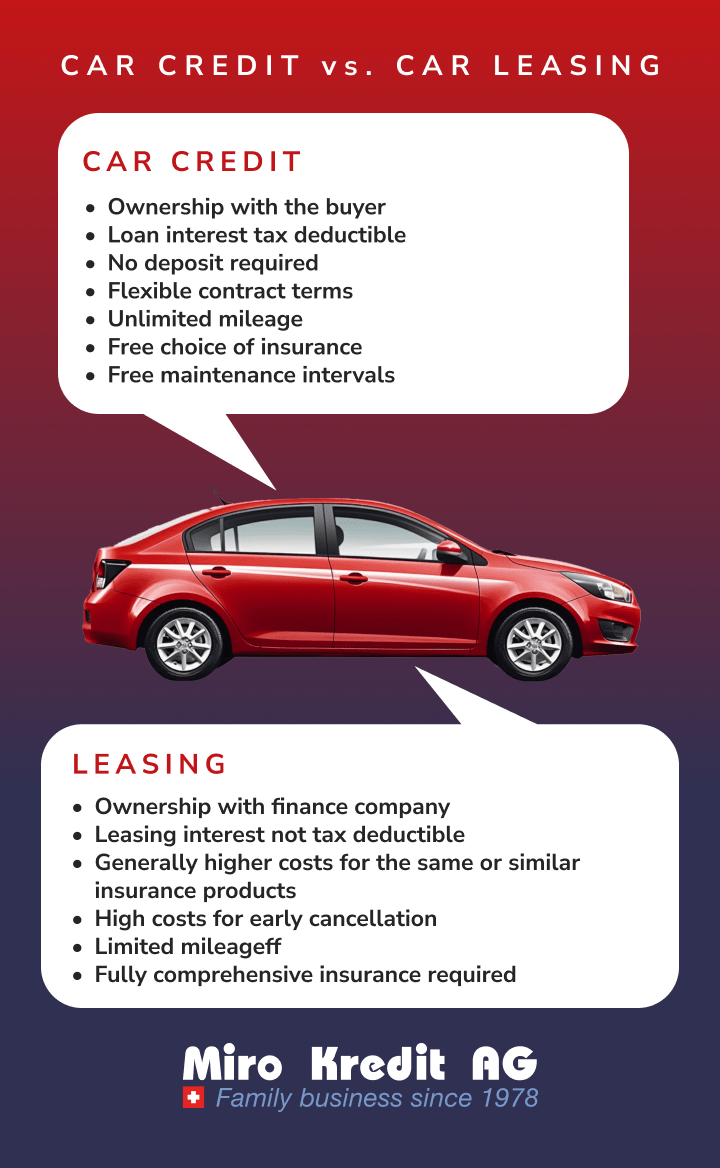

Lease or buy a car in Switzerland: A decision-making aid

As already mentioned, cash purchase is generally the cheapest way to finance a car. In addition, you are then the owner of the car and have a free choice of insurance. You can also usually decide on the color, equipment and other features yourself when buying a vehicle. If you would rather use the cash you have saved for something else, you can also opt for leasing.

If it is a classic leasing contract, you must take into account the repair obligations, return costs, and any premiums for fully comprehensive insurance. It is also important that when considering the vehicle costs, not only the leasing rate is taken into account, but an overall calculation is made.

When does it make sense to take out a loan for a car?

Compared to leasing, a car loan gives you much more freedom when it comes to the choice of insurance or garage. You are also free to sell your car at any time. Find out more about online credit in Switzerland here.

Instead, leasing binds you for the entire duration of the contract. The advantages of a car loan are:

- Own car from day one

- Down payment not mandatory

- Vehicle can be purchased from a car dealer or privately

- High discounts conceivable, because with a car loan you are considered a cash payer and therefore have more leeway

- No additional costs, processing fees or large catalog of conditions as with leasing

- Free choice of vehicle insurance and garage

- Loan interest can be deducted from taxes for car loans

How much should the loan for a car be?

Car loans are classed as consumer loans. Here, you are provided with a certain amount that you can use to pay for the vehicle. This includes the monthly payment:

- Part corresponding to the repayment of the loan

- Part that includes interest (amount depends on the amount borrowed and the loan term)

Loan term and monthly charge

When financing a car with a car loan, the term of the loan and the monthly payment are important factors. It is important that you think early on about how much money you can and want to pay per month for your car loan.

How much should you pay per month for the car loan?

As a rule of thumb, monthly installments should not exceed an average of 15% of net income. For example, if you take out a loan at the current interest rate to finance a car costing CHF 49,000, the monthly installment could be around CHF 1,102.70. We will inform you about the current interest rates.

When should a car be paid off?

The term of a car loan can be set as flexibly as possible. It is usually a period of 12 to 84 months, i.e. between one and seven years. Bear in mind that the shorter the term, the higher the monthly installments. If, on the other hand, you choose a longer term, you can better maintain your financial balance and invest in other areas of your life at the same time.

We can help you set a monthly rate that fits your budget perfectly.

What are the current interest rates for car financing?

As market conditions are constantly changing, we adapt our loan offers accordingly. The existing options also depend on the borrower’s creditworthiness. As experienced credit brokers, we have made it our mission to find the right installment loan for each individual customer, because a favorable loan is often the prerequisite for fulfilling life’s dreams.

Proven when it comes to financing: car loans from Miro Kredit AG

When trust is required from customers, competence, and experience are particularly important. Transparency and reliability are particularly important in credit transactions. Miro Kredit AG from Basel has been active as a credit broker since 1978 and can therefore point to a very high level of experience in arranging favorable loans.

The company always strives to offer its customers the optimal credit solution to realize important investments and long-awaited wishes. Vehicles and motorcycles in particular are often financed in whole or in part with a car loan, which is why the company has suitable offers available.

There are several advantages to financing a car or motorcycle with a loan from Miro Kredit AG: The interest incurred on the installment payment can be deducted from tax. Furthermore, there is no obligation on the part of the customer to take out fully comprehensive insurance for the vehicle.

Furthermore, the vehicle can be sold again at any time. Of course, the customer does not incur any costs when applying for a favorable loan. What’s more, applying for a loan is also efficient, as the car loan application with an integrated loan calculator can be easily completed and submitted online, after which customers will receive an answer within a short time.

We have been in this industry for a long time

- Family business since 1978

- Personal, independent and transparent

- Best financing solution

- Safe, discreet, and free of charge

- Highest loan amounts with lowest monthly installments

- Over 55,000 satisfied customers

Conclusion

Even if paying in cash is generally the cheapest way to buy a car, you don’t always have the opportunity to do so. For example, you could discover your dream car tomorrow. If you do not yet have the necessary financial means, this does not mean that you have to do without the vehicle you want or save for many years. The solution could be a car loan.

If you take out such a contract, you borrow the required amount of money and pay it back, including interest, over a predetermined term. Unlike leasing, the vehicle belongs to you, so you are free to decide on the color, equipment, and other features.

We can help you find a particularly favorable loan for your car financing and are always available to answer your questions about car loans and current interest rates. You can also use the car loan calculator on our website.

Private loan calculation example

Loan amount: CHF 10,000 without insurance.

Repayment period: 12 months

Interest (including costs) amounts between CHF 240.45 and CHF 523.30. Effective interest rate 4.5% – 9.95%. Possible loan repayment period from 12 to 120 months

Processing fees: CHF 0.-. Granting a loan is prohibited if it leads to over-indebtedness (§ 3 Unfair Competition Law – UWG)