Credit top-up

In today’s world, our financial needs can change more quickly than expected. You may be faced with unexpected expenses, or you may be planning major investments or purchases that exceed your current credit limit. In such situations, a credit top-up can be an attractive option to overcome your financial challenges without having to take out additional loans.

In this article, we would like to give you a detailed overview of what exactly a loan top-up means, how the process works, and what factors you should consider before deciding to top up your existing loan. We will also look at the various reasons why you may want to top up your loan and alternative options you should consider to meet your financial needs.

What exactly is a credit top-up?

Even if you are already servicing a current loan, you may need additional funds for a move or important new purchases. A loan top-up or loan increase allows you to increase an existing loan by a further loan amount without having to conclude a new loan agreement. However, increasing your existing loan is only possible if your personal financial situation allows it.

With the help of a credit top-up, you therefore have the flexibility to obtain an additional credit line without having to take out a separate loan. You can also have several loans with one or more lenders at the same time and obtain additional funds by taking out another loan.

How does a loan top-up work?

Basically, the process of increasing the loan is similar to the original loan agreement, although there are some specific differences. For example, the bank will re-examine your financial situation to ensure that you fulfill the requirements for an increase. The existing loan in your budget will be taken into account.

Your payment history with the previous lender is also checked, as it reports both positive and negative entries to the Central Office for Credit Information (ZEK).

If you have a regular and reliable payment history, this will of course have a favourable effect on the conditions of the top-up. If, on the other hand, you have numerous late payments, this will have a negative impact on your creditworthiness and therefore also on your chances and conditions for the top-up.

Regardless of whether the top-up is with the existing or a new provider, legally prescribed creditworthiness checks in accordance with the Consumer Credit Act (KKG), such as a credit check and a detailed budget calculation, must be carried out.

If the bank approves the increase, new conditions will be set, including the increased loan amount and the new repayment terms. These could include a change to the monthly installments, the term, or the interest rate – depending on the terms of your existing loan and the current market conditions.

Once all contractual conditions have been clarified, all you have to do is sign the new loan agreement and the increase will take effect. The loan amount will then be credited to your existing loan account and you can use it according to your needs.

Is it possible to increase the loan while keeping the installment rate the same?

It is possible to increase the loan without changing the installment by extending the term of the loan. If you increase an existing loan, the term can be adjusted – depending on the loan provider and the conditions. This means that your monthly loan installment does not necessarily have to increase, as the additional amount is spread over a longer term. This means that in many cases it is possible to increase a loan without increasing the monthly instalment.

How long does a loan top-up take?

The easiest way to apply for a loan top-up with Miro Kredit AG is to submit an online application via our website. In the application process, you can indicate whether you already have one or more current loans and select your desired loan amount. We will then need the following documents from you to take out the loan:

- Valid identity document (Swiss ID or foreigner’s identity card)

- Pay slips for the last three months

- Copy of the current loan agreement

As soon as we have received your documents, we will check them and send you the loan agreement with the best conditions free of charge and without obligation. Once we have received the signed contract, we will pay the money into your account after the statutory cancellation period of 14 days has expired.

Reasons for a loan increase

A credit top-up is a decision that consumers can make for a variety of reasons and can be a sensible solution in many situations. One of the main reasons for increasing credit is the need for additional funds – whether for planned or unexpected expenses.

People often need extra money for urgent home or car repairs, unforeseen medical expenses, or other unexpected financial emergencies. Consolidating existing debts or financing larger purchases as well as favorable interest rates can also be good reasons for increasing a loan. An increase in credit enables you to cover all these expenses without having to take out additional loans, which simplifies your financial situation.

Consolidation of liabilities

One of the most common reasons for a loan increase is to consolidate debts. If you have several loans or debts, it can quickly become difficult to keep track of the various payments and interest rates. By topping up your existing loan, you have the option of consolidating all your debts into a single loan. This has the advantage that you only have to make one monthly payment when you pay off a loan, which can significantly simplify your finances.

Consolidation can also help you benefit from a lower interest rate – especially if your credit score has improved since you took out the original loan. Not only can you keep your financial situation under better control, but you can potentially save money by paying less interest.

Favorable interest rates

A favorable interest rate level can be another important reason for a loan increase. If the current market interest rates are lower than the interest rates on your existing loan, you have the opportunity to benefit from more favorable conditions.

By borrowing additional funds at lower interest rates, you can make significant long-term savings and possibly even reduce your monthly payments. In this way, low interest rates can reduce the overall cost of the loan, resulting in lower interest payments.

In addition, a higher loan amount can also help make you a more attractive borrower to lenders, as they are often willing to offer lower interest rates on larger loans. In this way, an increase in credit can not only help to reduce your financial burden, but also improve your long-term financial health by allowing you to benefit from more favorable credit terms.

Financing large purchases

Sometimes consumers need additional funds to make major purchases or investments, such as buying a car, renovating a house or financing electrical appliances. In such cases, a credit top-up can be a practical solution. Instead of taking out a new loan, you have the option of extending your existing loan. This allows you to obtain the funds you need quickly without having to take out separate loans.

Furthermore, you can benefit from the already established conditions of your existing loan, which often means more favorable interest rates and more flexible repayment terms. In this way, you can efficiently cover your financial needs without the additional bureaucracy of applying for a new loan.

When does it make sense to top up a loan?

It always makes sense to increase your loan if your financial or family situation changes during the term of your existing loan. Life often holds surprises in store for which we are not sufficiently prepared. An increase in credit is the optimal solution here, which can help you to maintain your financial liquidity – and at the same or even more favorable interest rates.

Even if you are thinking about taking out a new loan to pay off your old one, you are not alone. Many people decide to take this step as it can save them money in the long run. A new loan can often offer a lower APR than your existing loan, meaning you can save money each month and throughout the term. In addition, a new loan can give you a longer repayment period, which in turn can lower your monthly installments, making it easier for you to afford your loan.

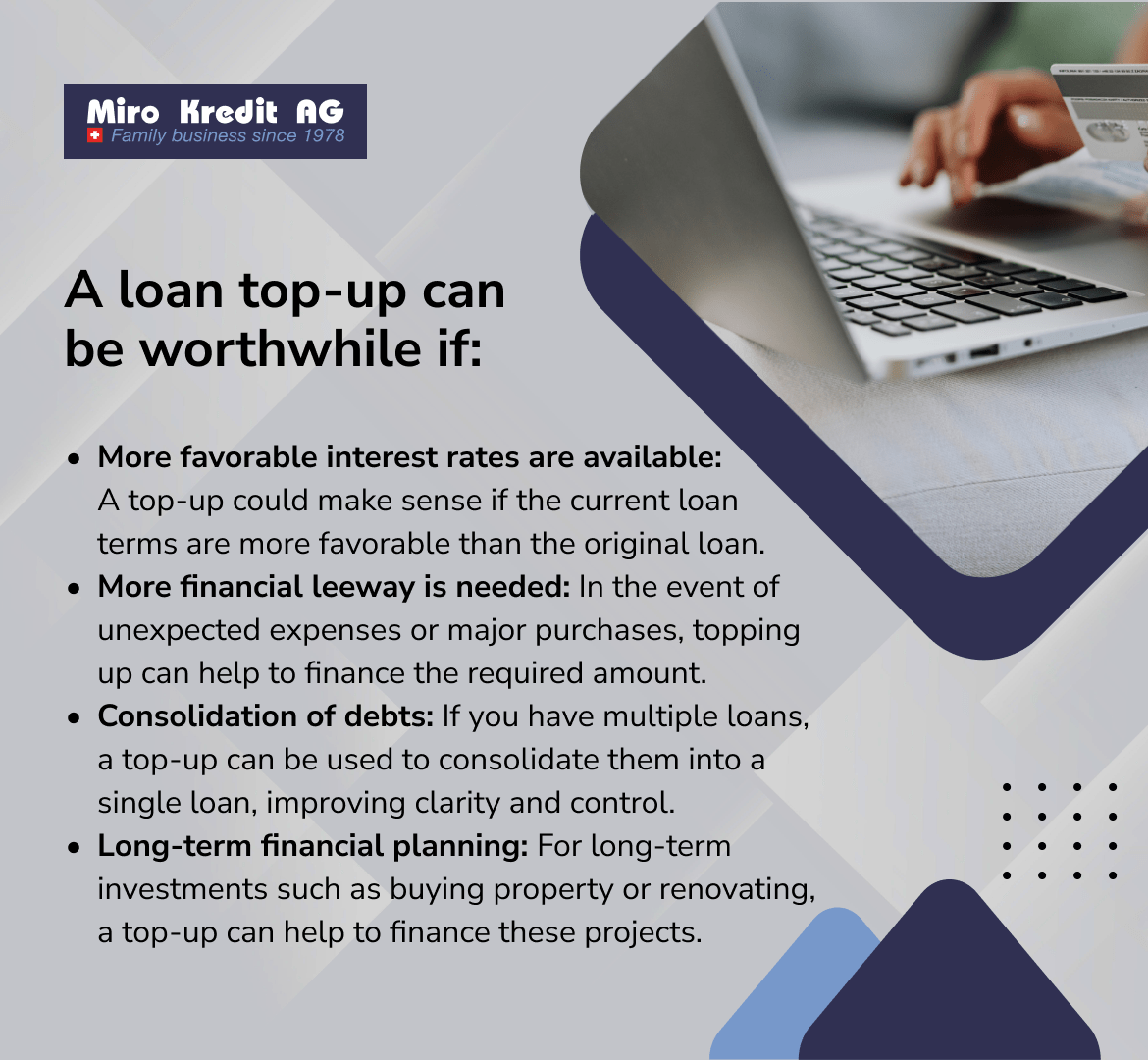

Overall, a loan top-up can make sense in the following cases:

- Increased financial requirements: If your financial situation has changed and you have additional financial needs, you can obtain additional funds quickly and easily by topping up your loan without having to take out a new loan agreement.

- More favorable conditions: If current interest rates are lower than the rates on your existing loan, topping up can be a way to take advantage of more favorable terms. This can help lower your monthly payments and save you money in the long run.

- Consolidation of debts: If you have multiple loans or debts, increasing your existing loan can be a way to consolidate all of your debts into a single loan. Not only does this simplify your finances, but it can also help you benefit from a lower interest rate and save money in the long run.

- Financing large purchases: If you are planning to make major purchases or investments, such as buying a car or renovating your home, a credit top-up can be a practical solution to get the funds you need quickly without having to take out separate loans.

What should you consider when increasing your loan?

As with regular borrowing, you should also consider a few important factors when increasing your loan to ensure that it is successful and meets your financial needs:

- Total cost: Make sure you understand the total cost of the top-up, including all interest, fees, and costs. You should also calculate exactly how the top-up will affect your monthly payments and your long-term financial situation.

- Terms of the new agreement: Read the new loan agreement carefully and pay attention to all terms and conditions, including interest rates, term, and repayment terms. Make sure you understand and agree to the new terms and conditions before signing the contract.

- Long-term effects: Think about how the increase will affect your financial situation in the long term. In principle, you benefit from better interest conditions with higher loan amounts, but you should definitely consider your long-term goals when deciding to increase your loan.

- Compare credit providers: Last but not least, you should take enough time to compare different providers and loan offers. Reputable loan brokers such as Miro Kredit AG can help you find the best loans at the most favorable conditions and ensure that the top-up meets your financial goals.

Are there alternatives to topping up?

If you are thinking about increasing your loan, you should also consider alternative options. In addition to a classic loan increase, you can also consider debt rescheduling or taking out another loan – depending on your financial situation and the goals you are pursuing.

Debt rescheduling

With debt restructuring, your existing debts are transferred to a new loan with more favorable conditions. The loan amount usually remains unchanged. However, the aim of debt rescheduling is to benefit from the more favorable interest conditions of another lender. You can therefore make savings and optimise your financial situation by rescheduling your debt.

However, you should bear in mind that debt rescheduling is only a particularly attractive option compared to increasing the loan if you can save considerable interest and possibly benefit from more flexible repayment terms. This can lead to considerable savings, especially if you are rescheduling a larger loan amount.

Debt rescheduling also gives you a better overview and structure of your financial obligations. By consolidating several loans with a new lender, the management of your debts is simplified and you only have to service a single loan installment.

Taking out a further loan

Another option instead of topping up your credit is to take out another loan to cover your financial needs. This can be particularly useful if you have already reached the maximum amount of your current loan and still need additional funds. Unlike topping up your loan, this option avoids any potential impact on the terms of your existing loan. However, with this option, you should be aware that taking out a new loan will result in you entering into a further monthly payment obligation and therefore increasing your overall debt burden.

Before deciding on one of the two alternatives, it is advisable to carefully consider which option best suits your financial situation. It is important to consider your current debt structure, your credit score and your long-term financial goals. An informed assessment can help you choose the option that best suits your needs and supports your long-term financial stability.

In addition, it may be beneficial to consult with a financial advisor or loan expert at Miro Kredit AG to discuss your options and make an informed decision. By working with an expert, you can conduct a comprehensive assessment of your financial situation and receive assistance in selecting the optimal solution to meet your individual needs.

FAQ

Conclusion

A credit top-up offers a practical way to increase your financial flexibility and achieve new financial goals without having to take out additional loans. By increasing your existing loan, you can benefit from improved conditions and potentially lower your monthly payments.

However, it is important to consider the decision carefully and weigh all the pros and cons before deciding to top up your existing loan. If you are unsure whether a top-up is the right option for you, it is advisable to seek advice from one of our financial advisors or credit experts at Miro Kredit AG in order to find the best possible solution for your individual situation. We will work with you to find the best option for your financial liquidity!

Private loan calculation example

Loan amount: CHF 10,000 without insurance.

Repayment period: 12 months

Interest (including costs) amounts between CHF 240.45 and CHF 523.30. Effective interest rate 4.5% – 9.95%. Possible loan repayment period from 12 to 120 months

Processing fees: CHF 0.-. Granting a loan is prohibited if it leads to over-indebtedness (§ 3 Unfair Competition Law – UWG)