Repay loan

If you want to optimize your financial situation or simply benefit from more favorable conditions, paying off a loan is an option worth considering. However, paying off a loan is not always the ideal way to save money.

In this article, you will find out everything you need to know about loan repayment, the reasons for paying off a personal loan early, and how loan repayment works.

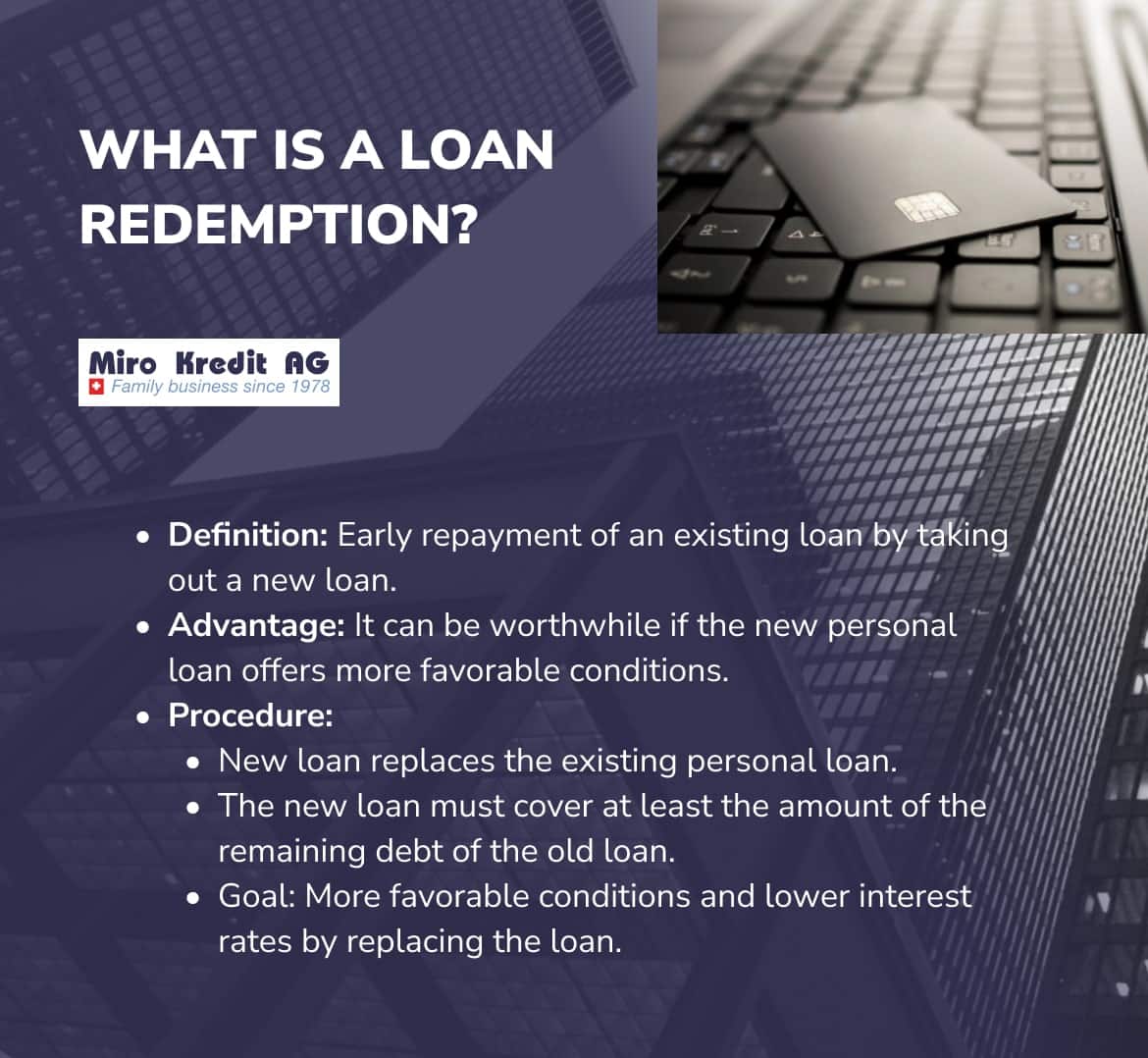

What is a loan redemption?

A loan repayment is the early repayment of an existing loan by taking out a new loan. It is generally not advisable to pay off existing loan installments with a new consumer loan, as this may lead to over-indebtedness. However, paying off a loan with a cheaper personal loan can be worthwhile under certain circumstances.

Replacing your current personal loan with a new loan from a different lender therefore works. However, this only makes sense if the new personal loan offers more favorable conditions. If you want to pay off your loan, the new loan must normally cover at least the amount of your existing outstanding debt with the previous lender.

What is the difference between redemption and debt restructuring?

Many providers use the terms “redemption” and “debt restructuring” interchangeably. However, a debt rescheduling differs from a redemption.

- Loan repayment: As already mentioned, loan repayment refers to repaying an existing loan in full and replacing it with a new loan with better conditions.

- Debt rescheduling: In a debt restructuring, all existing debts are first combined and then rescheduled with a new loan for this total amount. Here too, the aim is to reduce the overall costs of the loan. In addition, debt rescheduling has the advantage that the consolidation of all debts provides a better overview.

Essentially, paying off a loan is a form of debt restructuring, but the term “debt restructuring” refers more generally to the refinancing of debt – regardless of whether the new loan is taken out with the same bank or with a different lender.

Reasons to pay off a loan

In principle, it can be advantageous to replace an existing loan with a new loan with a lower interest rate. By reducing the interest charge, you can benefit from considerable savings. Replacing a loan can also make sense for numerous other reasons:

Low key interest rates

Replacing a loan can be worthwhile for you, especially if the interest rates on your current loan are high. The total costs of the new loan are the decisive factor here. If the new loan is considerably cheaper, debt restructuring or loan repayment is definitely an advantage. By reducing the interest costs, you can make considerable savings in the long term. Particularly in times when interest rates on the market are falling, it may be worth reviewing the conditions of your current loan and improving them if necessary.

However, it does not always make sense to pay off a loan. Interest rates for small loans are currently particularly low in Switzerland. This is why many borrowers want to pay off their previous, expensive loans. However, this is often only profitable if the remaining term is only one to two years.

Improving the financial situation

An improvement in your financial situation can be another important reason for paying off a loan. If you have a credit agreement with an interest rate that is too high, your financial situation may change over time. There may be an opportunity to obtain a better loan agreement with lower interest rates by reviewing it.

Even if your income situation has already improved or if you have paid off other debts and therefore have more financial resources, it may make sense to repay an existing loan early. Not only can you reduce your monthly charges, but you can also increase your financial flexibility and possibly work towards your financial goals more quickly. However, you should bear in mind that your one-off financial burden will be considerably higher here. Instead, it may make more sense to plan a debt restructuring in order to spread the costs of repaying the loan over a longer period of time and reduce the overall burden.

Poor credit conditions

There are also situations where you may not have received the best terms when taking out a loan. This could be due to a poor credit rating at the time of borrowing, unfavorable market conditions, or other factors. If the conditions for loans improve or if you can get better deals due to an improved credit rating, paying off your current loan may be a way to take advantage of these new conditions and reduce the overall cost of your loan.

In addition, the loan repayment itself can also improve your credit rating. Large loans are generally rated more positively than several small loans. By paying off the loan and then repaying the new loan on time, you may be able to further improve your credit rating.

Simplifying your own financial situation

Last but not least, a loan repayment can also give you a better overview of your finances – especially if you have several current loans. The interest costs of several small loans can quickly add up to a considerable sum. In addition, managing multiple loans can also become complex and cause you to lose track of your financial situation.

However, staying in control of your finances is crucial for healthy financial planning. By consolidating your small loans into a single loan, you can gain a better financial overview. Instead of dealing with multiple payments to different lenders, you only have to worry about one monthly payment. Not only does this make it easier to manage your finances, but it also allows you to better monitor your spending and income.

How does a loan repayment work?

According to the Swiss Consumer Credit Act (KKG), borrowers generally have the right to repay or redeem their personal loans early at no additional cost to the banks. The process of redeeming the loan involves the outstanding amount of the current loan being taken over by a new bank or lender offering better conditions. This may mean that you benefit from a lower interest rate or better repayment terms.

Repaying a loan is therefore a relatively simple process, but it does require a few steps to be completed successfully. First, you need to determine the current balance of your loan that you want to pay off. This amount includes not only the original loan amount but also any outstanding interest and fees.

Once you have determined the repayment amount, you will need to take out a new loan to pay off the old loan in full. This can be done at the same bank where you took out the original loan, or you can opt for a new loan provider that offers you better conditions. You apply for the new loan with the desired amount, which is sufficient to pay off the old loan in full.

Once the new loan has been approved, you use the funds to repay the outstanding amount of your old loan. This settles the old loan in full and you are now obliged to repay the new loan according to the agreed terms. This may include a similar monthly installment or other repayment terms, depending on the terms of the new loan.

What are the advantages of loan repayment?

The decision to pay off an existing loan can be an important step in creating a more stable financial future. In Switzerland, we at Miro Kredit AG offer you the opportunity to reconsider your financial situation through debt restructuring and potentially benefit from lower interest rates or improved credit terms. Repaying a loan can offer you a range of benefits that will help you improve your financial situation and achieve your long-term goals:

- Savings on interest costs: By taking out a new loan with lower interest rates, you can make significant savings on the overall cost of your loan in the long term.

- Improved conditions: With a new personal loan, you may also be able to benefit from other more favorable conditions, such as longer terms or more flexible repayment terms.

- Reducing the monthly burden: By paying off a loan that requires high monthly installments, you can reduce your financial burden and create more scope for other expenses.

- Simplify your finances: Consolidating multiple loans into a single loan can make managing your finances much easier and help you keep track of your debts.

We are on hand to offer you support and advice at every step of the process. Our experts will be happy to help you identify the best options for your individual situation and carry out the replacement process smoothly and efficiently.

When does it make sense to pay off a loan?

According to the Swiss Consumer Credit Act (KKG), borrowers generally have the right to make unscheduled repayments at any time. Such additional repayments allow you to save on the interest costs for the unused term. However, redeeming the loan with a new loan provider can also offer advantages in terms of conditions. There are various situations in which it can make sense to pay off a loan:

- If you have a loan with higher interest rates you have the option of taking out a new loan with lower interest rates.

- If your financial situation has improved and you would like to reduce the monthly charge.

- If you have several loans and want to consolidate them to simplify your finances.

- If the credit conditions on the market have improved you can benefit from better offers.

In any case, it is important to carefully weigh up the costs and benefits of loan repayment and, if necessary, seek professional advice to ensure that this is the right decision for your individual financial situation.

What does it cost if I pay off a loan early?

The early repayment of a current personal loan does not represent an additional financial burden for you. This is clearly regulated in the Swiss Consumer Credit Act (KKG). The KKG expressly provides for the possibility of early repayment of the loan debt. In addition, a loan repayment is free of charge at any time. According to Article 17 Paragraph 2 of the KKG, if you repay your loan early, you are even entitled to a waiver of the loan interest for the unused period as well as an appropriate reduction of the other costs.

In addition, regular repayment of the installments on your current loan will improve your credit rating. In turn, an improved credit rating can secure you lower interest rates for future loans or debt restructuring.

This means you can pay off your current loan without worrying about additional costs. On the contrary – early repayment can not only bring you financial benefits in the form of interest savings but can also improve your credit rating in the long term, which can benefit you when taking out new loans in the future.

Can I redeem a loan at any time?

Yes, as a borrower you have the right to repay your loan early at any time. If you would like to redeem your current loan with another loan provider, we at Miro Kredit AG will be happy to assist you. To make the process of redeeming your loan as smooth and efficient as possible, you can simply use our online loan application to request a loan redemption. Once we have all the necessary information about you and your current loan, we can proceed as follows:

- First of all, we will immediately obtain a loan offer from a new bank and apply for approval for the loan restructuring at the same time.

- As soon as your new loan agreement is active, the new bank will settle the outstanding loan amount with your current bank. This ends the contractual relationship with your old bank.

- You can look forward to considerable savings on interest costs as a result of your new loan.

If you are currently repaying several loans, you can easily bundle them together. This way, you have all your loans under one roof and with one lender. This also applies if you are already thinking about a new loan for your current consumer credit, for example, to buy new furniture, renovate your home, or buy a larger car. In this case, a credit top-up could be the right solution for you.

FAQ

Conclusion

The decision to pay off a loan is an important financial consideration that should be carefully thought through. Replacing a loan can be a rewarding way to benefit from lower interest rates or better terms. By reducing interest costs, you can make significant savings that can improve your financial situation in the long term.

If you would like to repay or restructure an existing personal loan, Miro Kredit AG will be happy to assist you. As a loan comparison platform, we offer you the best loan conditions so that we can find your ideal loan together.

Private loan calculation example

Loan amount: CHF 10,000 without insurance.

Repayment period: 12 months

Interest (including costs) amounts between CHF 240.45 and CHF 523.30. Effective interest rate 4.5% – 9.95%. Possible loan repayment period from 12 to 120 months

Processing fees: CHF 0.-. Granting a loan is prohibited if it leads to over-indebtedness (§ 3 Unfair Competition Law – UWG)