Use the 50/30/20 rule to achieve solid finances

Whether it’s day-to-day financial planning or applying for a loan, your financial situation and therefore managing your finances effectively is crucial to achieving long-term financial stability. A proven method to help you with monthly planning, budgeting, and even wealth accumulation is the 50/30/20 savings method. This simple but effective rule provides you with a clear structure to organize your income and expenses, allowing you to avoid financial shortfalls and save money at the same time. This way, you can reach your financial goals faster and improve your financial health.

But how exactly does the 50/30/20 rule work? Which savings tips make it easier to stick to this popular budgeting method and for whom is it actually suitable? You can find out all this in this guide from Miro Kredit AG.

The simple budget rule briefly explained

Originally, the idea of the 50/30/20 rule came from the book “All Your Worth: The Ultimate Lifetime Money Plan”, which was published in 2005 by Elizabeth Warren, bankruptcy law expert, former Harvard professor, and US senator, and her daughter Amelia Warren-Tyagi. With over 20 years of research experience, Warren and Warren-Tyagi confirm that complicated budget plans are often not necessary to get an overview of one’s finances.

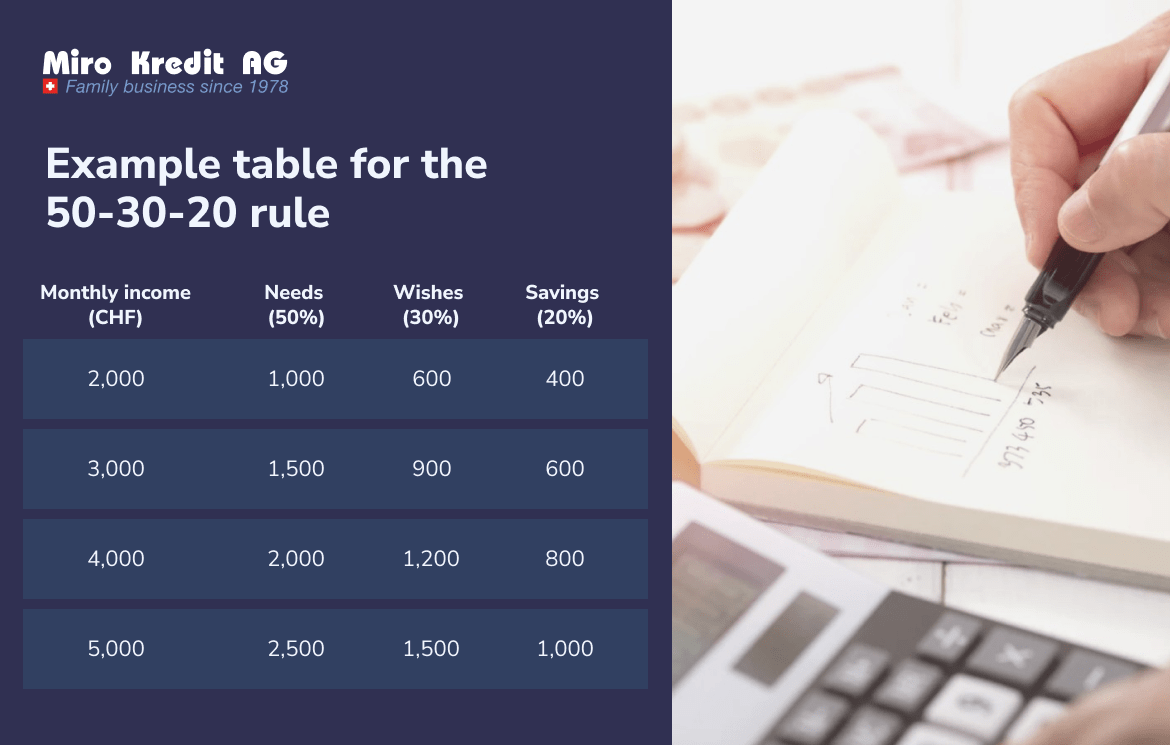

The 50/30/20 rule is a straightforward budgeting method that allows you to manage your money effectively, simply, and sustainably. The basic idea is to divide your monthly net income into three main categories: 50 percent for basic needs, 30 percent for wishes and personal needs, and 20 percent for savings or paying off debts, such as follow-up financing.

However, the 50/30/20 rule only serves as a rule of thumb for budget planning. The percentage distribution can vary depending on your personal financial situation, the local cost of living, inflation, and other factors.

Which points fall under the individual areas?

The 50/30/20 rule simplifies your budget planning by dividing your monthly net income into the categories of basic needs, wants, and savings or debt reduction.

If you know exactly how much money you want to spend in each category, you can easily stick to your budget plan to avoid living beyond your means. This is what your budget will look like if you apply the 50/30/20 rule:

50 percent for necessary expenses and fixed costs

Necessary expenses and fixed costs include all expenses that you cannot avoid. These are therefore your basic expenses for the things you need to live or run your household. The 50/30/20 method allocates 50 percent of your net income to your basic needs. This includes:

- Rent or mortgage payments

- Utilities (electricity and gas)

- Communication (telephone, mobile phone, Internet)

- Transport costs

- Insurances

- Groceries

If your expenses for basic necessities are well above 50 percent of your net income, it is advisable to make some adjustments. For example, you could change your energy provider or look for a cheaper apartment.

30 percent for variable expenses and individual needs

You can use another 30 percent of your net income for wishes, leisure activities, and personal needs. Wishes are expenses that are not essential to life. These include, among other things:

- Restaurant visits

- Shopping

- Travel

- Gym membership

- Entertainment (streaming providers, books or cinema)

- Luxury articles

- Hobbies

If you realize that you are spending too much on what you want, you can consider which expenses you could cut back on.

Save 20 percent or use it for loan repayments

After you have spent 50 percent of your monthly income on basic needs and 30 percent on wants, you can use the remaining 20 percent to achieve your savings goals or pay off outstanding debts. This remaining portion of your income is intended for the following things:

- Reserves

- Investments and long-term financial investments

- Retirement provision

- Debt repayment and loan repayment

How do you manage to stick to the rule?

Although budgeting with the 50/30/20 rule is relatively simple, it requires a high degree of discipline and conscious financial planning. The 50/30/20 savings method can only be successful if you pay attention to the following points:

- Adaptability: Although the rule seems rigid at first glance, it is flexible and adaptable. For example, if basic expenses account for less than 50 percent of your income, you can use more for personal expenses or savings. Conversely, it may be necessary to adjust the rule individually if your expenditure on basic needs exceeds 50 percent.

- Prioritise: To be successful, you should learn to prioritize spending to find a balanced approach that takes into account both your financial goals and your usual quality of life. By clearly defining and prioritizing your goals, you can ensure that you are using your financial resources effectively.

- Discipline: Last but not least, adhering to the 50/30/20 rule requires discipline and commitment. You should therefore consistently stick to your set budgets and adjust them in good time if your income or goals change. By consistently implementing the rule, you can achieve long-term financial stability and even accumulate some wealth in your account balance to achieve your financial goals.

Specific tips that make compliance easier

Determine budget and expenses precisely

Start by defining your budget precisely and reviewing your expenses carefully. Take time to record all your monthly expenses, including fixed costs such as rent, insurance, and debt repayments as well as variable expenses such as food, transport, and leisure activities. The more accurately you identify your expenses, the better you can plan and ensure that you adhere to the 50/30/20 rule.

Separate savings portion at the beginning of the month

An effective way to ensure that you keep to your savings percentage according to the 50/30/20 rule is to separate this amount at the beginning of the month. Once you have received your monthly income, it is best to transfer the set amount directly to a separate savings account or another form of long-term investment. This will ensure that you reach your savings target before you use your money for other expenses.

Reduce spending

Once you have gained an overview of your monthly expenses using the 50/30/20 rule, it can be useful to reduce them and find savings. So start by reviewing your spending and identifying where you may be spending unnecessary money. This could mean cutting out luxury items, finding cheaper alternatives, or negotiating with suppliers to get better prices. By reducing your spending, you can create more room for savings and debt repayments while improving your financial health.

What you should use the savings portion for

The savings portion of the 50/30/20 rule plays a very special role in securing your long-term financial future. You should therefore use this part of your income wisely to achieve your financial goals and make provisions for unforeseen events.

- Build up an emergency fund: A substantial portion of your savings should be used to create an emergency fund. This fund is used to cover unexpected expenses, such as car repairs, medical emergencies, or the loss of your job. Experts recommend keeping three to six months of expenses in your emergency fund to ensure financial stability in times of crisis.

- Finance long-term goals: You can also use your savings portion to finance long-term financial goals. This includes buying a property, your children’s education, or preparing for retirement in the form of a pension.

- Reduce debt: If you have debts, you should also use part of your savings portion to reduce these debts more quickly. You should focus primarily on paying off high-interest debts such as credit cards or personal loans to minimize interest and reduce your financial burden.

- Make investments: Your savings portion can also be an opportunity to make your money work for you by investing in different assets. From shares and bonds to property and commodities, there are a variety of investment options that can help you build long-term wealth and achieve your financial goals.

Is the rule suitable for everyone?

Although the 50/30/20 rule is a useful guideline for budgeting, it may not be suitable for everyone. For example, the rule can be particularly helpful for people who have difficulty controlling their spending or developing effective savings behavior. The rule can be particularly helpful for people who find it difficult to control their spending or develop effective saving behavior.

However, there are some situations where the 50/30/20 rule may not be optimal. For example, people on very low incomes may struggle to save 20 percent of their income, while others may need a higher savings percentage to meet their specific financial goals. Here, it may make sense to consider a different budgeting method that better suits individual needs and goals.

Conclusion

Following the 50/30/20 rule doesn’t mean you can’t enjoy your life – it simply means being more responsible with your money by identifying the areas in your budget where you’re spending unnecessarily.

The 50/30/20 method can also help you to pay off loans or other payment obligations more quickly. In this way, you can save your money and use it to build up your assets so that you are in a better financial position in the long term.

Private loan calculation example

Loan amount: CHF 10,000 without insurance.

Repayment period: 12 months

Interest (including costs) amounts between CHF 240.45 and CHF 523.30. Effective interest rate 4.5% – 9.95%. Possible loan repayment period from 12 to 120 months

Processing fees: CHF 0.-. Granting a loan is prohibited if it leads to over-indebtedness (§ 3 Unfair Competition Law – UWG)