What is a consumer loan

Are you dreaming of a new car or renovating your home, but lack the necessary capital? A consumer loan could be the ideal solution. Consumer loans offer you the possibility of financial flexibility – no matter what your dreams or needs are. Whether you need to cover unexpected expenses, make planned investments, or finance special occasions, a consumer loan can help you realize your plans.

But what is a consumer loan anyway? What can you use a consumer loan for and what options does Miro Kredit AG offer you?

The Consumer Credit Act (KKG) specifies different types of credit

The Swiss Consumer Credit Act (CCA) defines various types of credit, including consumer credit. Consumer credit is divided into different categories according to the Consumer Credit Act:

- Cash loans: Cash loans are traditional consumer loans where the borrower receives a fixed loan amount from a lender and repays this over an agreed period of time. This type of consumer loan is also often referred to as a personal loan.

- Leasing agreements: In leasing agreements, the lender lends the borrower an item, such as a car or electronic equipment, for a certain period of time in return for payment of a monthly amount.

- Overdrafts: Overdrafts, also known as current account overdrafts, are also a type of consumer credit. However, these are generally only considered consumer credit if an interest-bearing installment facility is activated.

- Contracts to finance the purchase of goods and services: Furthermore, contracts for the financing of the purchase of goods and services also fall under consumer credit, provided that interest is incurred on the partial payment.

When is it a consumer loan?

In general, consumer credit under the Consumer Credit Act covers loans to private individuals in the range of CHF 500 to CHF 80,000 with a term of more than three months. According to the Consumer Credit Act provisions, a consumer loan therefore exists if a professional lender grants a private individual, referred to as a consumer, a loan that is not intended for professional purposes but – as the term already suggests – exclusively for consumption.

As already mentioned, this type of credit can take various forms, including cash loans, contracts to finance goods or services, leasing contracts, current account overdrafts, or credit and debit cards.

A consumer loan is therefore when a person or family takes out a loan to buy consumer goods or services that are not considered an investment. Typical examples of consumer credit are the purchase of a car, the renovation of a house, or the purchase of new furniture. However, loans taken out for professional or commercial purposes, mortgages, or Lombard loans are not considered consumer loans.

Consumer loans can be offered with different conditions and interest rates. Before taking out a consumer loan, it is advisable to carefully compare the different offers and make sure you fully understand the terms and conditions.

Some lenders may also offer additional services such as credit insurance or payment protection insurance, which can protect the repayment of the loan in the event of unemployment, illness, or other unforeseen circumstances.

If you have any questions about consumer loans or other financial products, the experts at Miro Kredit AG will be happy to help.

What are consumer loans used for?

Consumer loans can be used for a variety of personal expenses that often cannot be financed from current income. Although consumer loans are primarily aimed at financing consumer goods such as consumer durables and consumer durables, they are often also used for unforeseen everyday expenses.

The most common uses of consumer credit include the purchase of cars, furniture, electronic devices, or household appliances as well as the financing of renovation work with a renovation loan. Planning and paying for a wedding is also conceivable with a consumer loan.

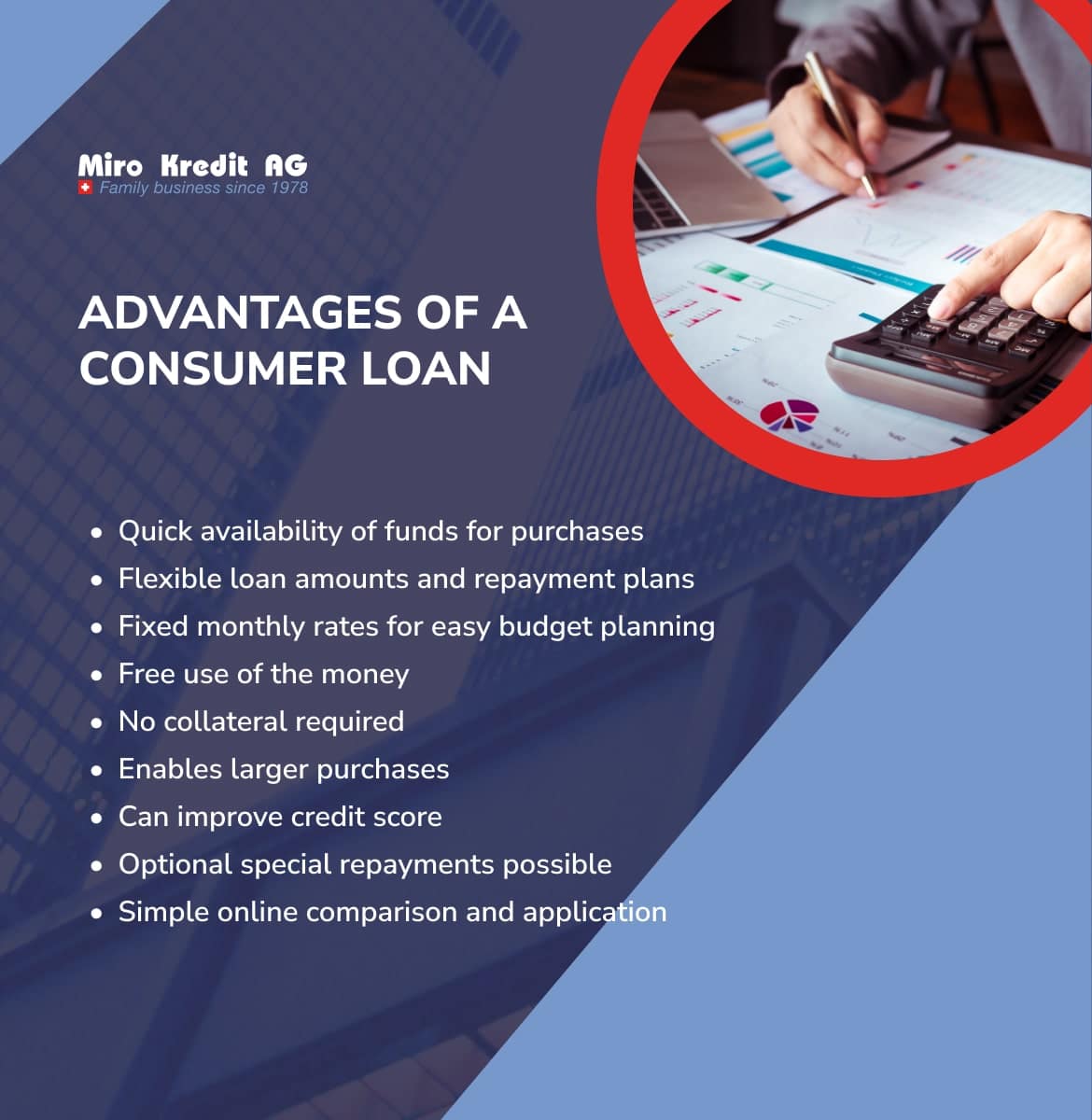

In general, a consumer loan gives you the flexibility to make larger purchases immediately and spread the costs over a fixed period of time, rather than having to raise all the money at once. As consumer loans are not usually tied to a fixed purpose, taking out such a loan has considerable advantages for consumers.

Miro Kredit AG arranges consumer loans transparently and conveniently at top conditions

Are you also interested in a consumer loan to fulfill a long-awaited dream? Then Miro Kredit AG is your partner! We stand for transparency and convenience in arranging consumer loans at first-class conditions.

Our goal is to make it easier for our customers to access financing options by providing a transparent and user-friendly process. We understand that taking out a loan is an important financial decision and therefore we emphasize providing our customers with comprehensive information about their options.

Thanks to our many years of experience in the credit market, we have a broad network of partner banks and lenders from whom we can obtain tailor-made offers for our customers. We work hard to find the best conditions for each individual customer – be it in terms of the interest rate, the term of the loan, or other important conditions. In doing so, we always ensure that our customers receive fair and transparent treatment.

Our online platform offers you a convenient way to compare and apply for consumer loans. With just a few clicks, you can view various offers and choose the one that best suits your needs. Use our loan calculator, to find the right consumer loan for your needs and financial means.

Simply enter your desired loan amount and term and you will immediately receive an overview of the monthly installments. Then all you have to do is enter your personal details and, after checking your information, you will receive your individual consumer credit agreement with the best conditions.

We strive to be a trustworthy partner that our customers can trust at all times. So you can be sure that you will not only receive a loan from us but also a service that is tailored to your individual needs.

FAQ

Private loan calculation example

Loan amount: CHF 10,000 without insurance.

Repayment period: 12 months

Interest (including costs) amounts between CHF 240.50 and CHF 574.25. Effective interest rate 4.5% – 11.95%. Possible loan repayment period from 12 to 120 months

Processing fees: CHF 0.-. Granting a loan is prohibited if it leads to over-indebtedness (§ 3 Unfair Competition Law – UWG)